Q3 2024 Market Recap

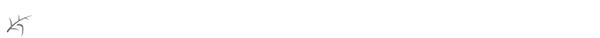

As the saying goes, “All’s well that ends well.” While the third quarter ended with both stocks and bonds solidly in green, the summer wasn’t all blue skies and beach days for investors. A short but harsh selloff in early August, triggered by renewed recession fears and an unwinding of the Yen carry trade, followed by another quick selloff the first few days of September, led to much second guessing about the near-term future of markets.

However, relief for investors came in the form of the long-awaited first interest rate cut by the U.S. Federal Reserve, leading to rallies in both stock and bond markets. This change in interest rate policy brought with it a rotation into some of the previously forgotten corners of the market, with value/dividend stocks meaningfully outperforming their growth counterparts in the quarter.

As mentioned above, market gains in the quarter were led by value stocks. The Dow Jones Industrial Average rose 8.7%, outperforming the growth-focused NASDAQ Composite Index (+2.8%) by nearly 6%! The S&P 500 Index grew by 5.9%, led by gains in the utilities (+19.4%) and real estate (+17.2%) sectors. Information technology (+1.6%) would have been the worst performing sector, if not for the energy sector (-2.3%) being dragged down by a 12% decline in oil prices.

With the sector rotation in markets and the Bank of Canada firmly settled into their rate-cutting cycle, Canadian markets performed exceptionally well, with the S&P/TSX Composite Index returning a whopping 10.5% in the quarter. Like the U.S., the real estate (+22.9%) and utilities (16.6%) sectors performed well, but it was the strength in Financials (+17.0%) that made the largest contribution to Canadian markets, given its 30%+ index weighting.

European markets (MSCI Europe +5.3%) performed roughly on par with the broad U.S. market, as inflation cooled and expectations that the European Central Bank will continue cutting rates widened. Despite Chinese stocks rising more than 22% on the back of more government stimulus, the international story of the quarter was the unwinding of a Yen carry trade (borrowing cheaply in Japan to buy higher-yielding investments elsewhere).With the Bank of Japan raising rates to their highest level since 2008, the Yen jumped 12.5%, leading to much of the quarter’s volatility worldwide.

Bond markets continued their momentum in Q3, as central banks settled into their rate-cutting cycles and yields continued to fall. The FTSE Canada Bond Universe gained 4.7% for the quarter, while the Morningstar Global Core Bond Index rose 5.6%.

OUTLOOK – Inflation’s last mile

As we discussed last quarter, there is a certain level of complacency in markets. Markets have seen relatively little volatility this year, and there is abroad consensus that central banks have/will get it all right and achieve the holy grail of an economic soft landing. One area the market may be overestimating though is the ability of central banks (specifically the U.S. Federal Reserve) to easily return inflation to their 2% target.

This is not to say we expect another broad spike in price pressures. Inflation in both Canada and the U.K. fell below 2% in September, raising odds of a half-point reduction at the next Bank of Canada meeting, and the European Central Bank is also expected to continue with their rate-cutting cycle. However, in the U.S., which still accounts for more than ¼ of the world’s economy, inflation may yet prove harder to tame. According to Steven Blitz, Chief U.S. Economist at TS Lombard, “There is a bubbling sense that the absolute conviction of inflation returning to 2% might be more faith than fact.”

It may be a classic case of the “last mile” problem. Originally a transportation and logistics concept, the last mile problem refers to the difficulty associated with the final step of delivering a product or a service. Think about painting a room – you can quite quickly roll out the walls and ceiling, but the trim and baseboard (the painting last mile) are small and full of corners and edges, thus requiring more attention to detail and generally taking more time and effort than other parts of the job.

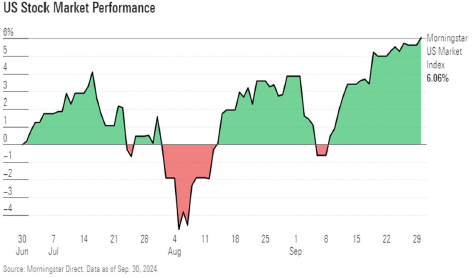

While U.S. inflation has been on a steady decline since mid-2022, recent data has been mixed, highlighted by an increase in core CPI (the first acceleration in core CPI in 18 months), soaring gold prices, and an increase in long-term inflation expectations (as shown on the left). The last push of inflation down to 2% may be harder to achieve than the reductions we’ve already seen, and there are a number of reasons why this may be the case:

Strong consumer spending – solid income growth and ample savings (buoyed by strong markets) continue to fuel the economy. While labour markets have slowed, layoffs remain historically low, and consumers seem eager to spend, with 2024 holiday spending expected to grow by 2.2%-3.3% versus last year.

Conflict in the Middle East – if fighting is prolonged or escalates further, energy supplies could be disrupted, leading to a spike in oil prices.

Politics – Both Democrats and Republicans have economic agendas that could be inflationary. Democrats have plans to increase government spending and cut taxes for the middle class (the group often viewed as the engine of consumer spending). Republicans, on the other hand, have tariffs as the centrepiece of their economic agenda, and Goldman Sachs estimates that those policies would add about 1 percentage point to the U.S. inflation rate.

In recent comments about the potential impact of tariffs, Raymond James Chief Economist Eugenio Alemán explained: “If inflation increases, then the Fed may be pushed to either increase interest rates or keep interest rates higher for longer compared to a no-tariff-war scenario or until the effects from the tariffs are pushed through the U.S. economy. It is difficult to know the actual impact on overall inflation, but an across the board increase in tariffs has the potential to push inflation higher.“

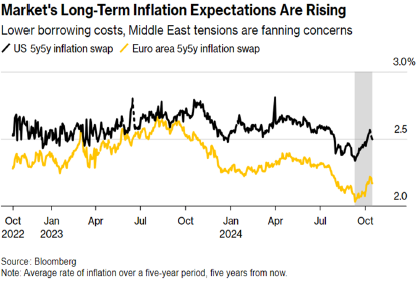

None of this is to say with certainty that a 2% inflation target will not be reached; however, the widespread conviction that this target will be easily achieved may prove overly optimistic. With markets confidently planning for a steady decline in rates, any changes to the expectations for pace, timing, or direction of interest rate policy could lead to unexpected volatility.

Does this change our long-term view on markets and portfolio positioning? Absolutely not, but remember that the S&P 500 Index fell more than 10% last year on concerns that the Fed would keep interest rates higher for longer in response to persistently elevated inflation. We’ve expected an increase in volatility for some time, and our old foe inflation may once again prove to be one of the sources.

Investors would be wise to remain vigilant and ensure portfolios are invested to match their long-term needs and objectives. As always, if you have any questions or concerns, please do not hesitate to reach out.

Sincerely,

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.

Raymond James Ltd. has also provided investment banking services within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.