Q4 2024 Market Recap

Entering the fourth quarter, investors were laser-focused on one thing and one thing alone… the November 4th U.S. election. Having already been rewarded with strong returns through the first three quarters of the year, markets traded sideways in the early part of the quarter, waiting for U.S. election results to help decide their next move. The clear Republican victory sent stocks soaring (up nearly 6% in the week following the election), buoyed by expectations that Trump’s policies would lift growth, lower taxes, and cut regulation. This optimism came to an abrupt halt in December though, as the U.S. Federal Reserve tempered its outlook for further interest rate cuts, amid strong employment numbers and stickier-than-expected inflation. Markets still ended the quarter higher, but below their post-election peak.

In the U.S., gains were more subdued than in previous quarters, with the S&P 500 Index up 2.4% and the Dow Jones Industrial Average (DJIA) up just 0.9%. The NASDAQ Composite Index was the strongest performer (+6.4%), led by gains in the “Magnificent Seven” stocks. Only 4 of 11 sectors were positive in the quarter, led by consumer discretionary (+14.3%) and communication services (+8.9%), both of which count Magnificent Seven stocks as their top two holdings. Materials (-12.4%) and healthcare (-10.3%) headlined the decliners.

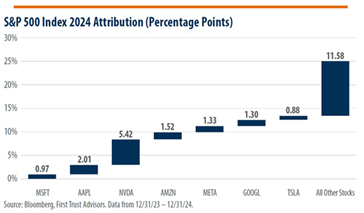

Full-year returns were once again impressive, with the S&P 500 Index up 25.0%, the DJIA up 15.0%, and the NASDAQ Composite Index up 29.6% (these figures include dividends). However, like 2023, digging below the surface of these headline returns tells a still positive, albeit different, story. As seen in the chart to the left, the Magnificent Seven stocks, which now make up a more than 30% weighting in the S&P 500, accounted for 53.7% of the index’s gain for 2024. Without these seven stocks, the remaining 496 stocks (the index contains 503 stocks) would have averaged +11.6%. While some investors might find themselves disappointed that most portfolios lagged the headline returns, it’s important to recognize the challenge in comparing a diversified portfolio to an index led by such a narrow group of companies. While most portfolios include fixed income and allocations to other regions (further complicating direct comparison), a more appropriate proxy for U.S. equities is the Equal Weighted S&P 500 Index, which was up 13.0% (including dividends) for 2024.

Canadian stocks had a much stronger year in 2024 than 2023, with the S&P/TSX Composite Index up 21.7% for the year, including dividends (+3.8% in Q4). The rally in Canada was more broad-based than the U.S. with the equal weighted index outperforming the main index (+21.74% vs. +21.65%). The financials sector, which accounts for roughly 1/3 of the S&P/TSX Composite Index, contributed the most to gains, trailing only information technology (+39.4%) in terms of absolute return. The only negative sector for the year was communication services (-21.1%), as these companies struggled with slower growth and higher debt payments. Given a weaker growth outlook, the Bank of Canada was more aggressive in 2024, cutting rates by 1.75%, vs. 1.00% for the U.S. Federal Reserve.

European shares largely declined in the fourth quarter (the MSCI Europe ex-U.K. Index was down 3.6%), amid political instability in France and Germany, as well as trade tariff concerns with incoming president Donald Trump. While European markets finished the year up 8.1%, the region is struggling with lacklustre growth, prompting the European Central Bank to cut rates four times (total of 1.35%) in 2024. Much like Europe, emerging markets and specifically, China (-7.0%), fell in the quarter, as investors face concerns over proposed tariffs. Chinese stocks finished the year up 19.8%, but the 2025 outlook is murky, given subdued consumer spending and a trade war with the U.S. that is expected to re-accelerate.

Bond markets had a volatile quarter, driven by geopolitical tensions and concerns over potential inflationary policies proposed by the incoming U.S. administration. An unexpected uptick in inflation in the U.S. and the Federal Reserve’s subsequent comments tempering rate cut expectations sent yields higher and bond prices down. The FTSE Canada Bond Universe fell 0.04% in Q4, ending the year up a respectable 4.2%. Meanwhile, the Morningstar Global Core Bond Index rose 1.0% in the quarter, ending the year up 7.0%.

In many ways, 2024 was a continuation of 2023 with the U.S. economy remaining resilient and outperforming other developed markets. Tech and specifically, the Magnificent Seven drove market returns, while “growth” stocks once again outperformed “value” stocks. The combination of strong market returns and resilient growth has led many to conclude that a “soft landing” has been achieved and the consensus view seems to be that earnings growth will accelerate in 2025, lifting markets further.

OUTLOOK

Two questions dominate conversations at this time of year: “What’s the market going to do this year?” and “Should we expect a market crash?”

- 1. What’s the market going to do this year?

What will it be – +5%? -8%? +11%? The easy answer here is…probably not what’s expected. No one knows what the future holds, and if history is a guide, the consensus expectation is likely not going to be correct. While Wall Street firms are all quick to issue their latest forecasts and price predictions for the coming year, investors would be wise to take these with a grain of salt. For the S&P 500 Index, the average return prediction for 2025 is +9.1%. That shouldn’t be too surprising, as it aligns with historical averages and few prognosticators really want to stick their necks out on these kinds of predictions. Bloomberg did a study of 376 firm forecasts over the last 25 years and found that 53% of the predictions were between 0-10%.

The problem with this is that specific predictions are largely a guessing game that we’re not terribly good at. As shown on the right, about 40% of the time, the actual return falls outside the range of all forecasts – including four out of the last five years! This is something to keep in mind next time you’re watching BNN or CNBC or reading a “financial expert” column.

With the above said, predicting a specific target or return doesn’t seem to hold much value. Instead, we’ll focus on a couple areas where markets could diverge from the general view.

As previously mentioned, strong market returns and resilient U.S. growth have led many to conclude that a “soft landing” has been achieved, and the consensus view is that earnings growth will accelerate in 2025, lifting markets further. We’re not as convinced that the coast is completely clear, due to the following:

- Valuations are high – historically, this is a sign to temper expectations for future returns.

- The S&P 500 Earnings yield is below that of the U.S. 10-year Treasury Bond yield – according to Bipan Rai, Head of ETF Strategy at BMO, “The last time this was a frequent occurrence was around the turn of the century – when the S&P 500 struggled to generate much in the way of momentum.”

- The U.S. deficit and no real plans to address it – the incoming administration is inheriting a large deficit, and yet, still expect to push through tax cuts. It’s hard to see the market ignoring a lack of effort to address this, especially if interest rates remain structurally higher.

None of this is to say that we think U.S. markets are in a bubble or there are no compelling investment opportunities. It’s just that being complacent and expecting the same trends to continue indefinitely comes with risk, and we wouldn’t be surprised if the consensus is a little over-optimistic about the so-called U.S. exceptionalism theme. Canada, on the other hand, may face the opposite view. The overwhelming consensus is that Canadian markets will suffer, with possible trade tariffs hanging over the economy and slower expected growth. Yet, the S&P/TSX Composite Index trades with a forward price-to-earnings ratio of 15.1 (vs. the S&P 500 Index at 21.8), the Bank of Canada is expected to continue cutting interest rates, and the lower Canadian dollar is helping both exports and companies with USD earnings. Perhaps there are opportunities for surprises to the upside here?

- 2. Should we expect a market crash?

We’ve seen numerous articles and predictions that some sort of market crash is looming. Usually, the logic is that markets keep hitting new highs and we are sitting at high valuations, so a crash must be imminent. While a market crash is never out of the question, we don't put much weight on one-dimensional predictions like these.

As discussed earlier, recent market performance has been concentrated to a small number of companies in the U.S. The top 10 companies in the S&P 500 Index make up nearly 40% of the index today, the highest it's ever been. This also means that these companies have an outsized impact on things like valuations and price-to-earnings (PE) ratios. As noted above, the S&P 500 Index (which is market cap weighted, meaning bigger companies are weighted more heavily) has a forward PE ratio of 21.8. By comparison, the Equal Weighted S&P 500 Index (where all companies have an equal weight) has a forward PE ratio of only 16.6 – this means that many companies are not trading at the same expensive valuations of the handful of mega-cap technology companies.

Despite the fact that the S&P 500 Index’s forward PE ratio of 21.8 is above the 10-year average of 18.2, we need to keep in mind that valuations don't have a great history of predicting crashes. Ben Carlson (author of the “A Wealth of Common Sense” book & blog) writes: “The majority of stock market slumps may have occurred coming off of elevated valuations, but there’s no threshold level that, once breached, gives investors a clear signal to get out.” While we firmly believe investors are right to temper expectations about future returns due to high valuations (in a recent strategy paper, Goldman Sachs suggested the S&P 500 Index could average just +3% per year over the next decade), there's no clear relationship between crashes and valuation levels.

And while much about the current market environment is unique (including the previously discussed concentration, high valuations and resilient economic growth in the face of historically recessionary indicators), the one thing that is decidedly average is the size and duration of this bull market. Since the market lows in October 2022, the S&P 500 Index has risen 66% over the previous 26 months. According to Fidelity, bull markets have lasted a median of 42 months on average and seen the S&P 500 Index rise by a median of 87% over their run.

None of this is to say that a crash won't happen. It could, but most crashes are precipitated by something unexpected and that few saw coming. What we feel as a more likely scenario is muted returns and the return of volatility. Longtime market strategist Jim Paulsen recently wrote: “In the past, bull markets have tended to start off strong, returning nearly 40% during their first year, then lose steam as time goes on. The average return for years 2.25 to 3.25 — a period that roughly corresponds to 2025 for the current bull market — is just 4.8%. During the first year of a bull market, the chances the stock market will endure a correction — defined as a decline of 10% to 20% — was just 40%. But by the time a bull market gets to its current age, the chances a correction will occur in the next 12 months jump to 75%.”

So, how do we think investors should prepare for 2025? It all starts with sticking to your plan.

- 1. Focus on quality – Don’t get tempted to chase returns in the current “hot” idea. Remember the classic Benjamin Graham quote: “In the short turn, the market is a voting machine; but in the long run, it is a weighing machine.” Quality matters and businesses with strong cashflows and solid financial positions will ultimately be rewarded.

- 2. Focus on income – Dividends matter. They help reduce volatility and comprise a significant part of returns. Since 1926, dividends have contributed nearly one-third of the total return for U.S. stocks. From 1980 to 2019 (a period characterized by a significant decline in interest rates), 75% of the return of the S&P 500 Index came from dividends.

- 3. Stay diversified and stay invested – While U.S. markets have driven returns in the previous two years, they won’t always. Other markets (including Canada) trade at lower valuations and have lower expectations. Similarly, fixed income may seem unexciting but will provide ballast to portfolios in the event of volatility. While one can be tempted to shift to a more defensive strategy during rough patches, equity markets generally recover more quickly than most think (see chart to the right). Trying to time markets is rarely a strategy for success.

- 4. Have a cash flow plan – If you are drawing income, or plan to draw income from your portfolio, make sure you have a plan to ensure your income needs for the next few years can be met without selling equities. Adding fixed income or a GIC ladder will buy plenty of time to let equities recover in the event of a market correction.

As always, we are here to answer any of your questions, so please do not hesitate to reach out.

Sincerely,

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.

Raymond James Ltd. has also provided investment banking services within the last 12 months with respect to Capital Power Corp., goeasy Ltd., WSP Global Inc., and Intact Financial Corp.