Q1 2024 Market Recap

Markets entered 2024 feeling quite confident that inflation was under control, rate cuts were forthcoming, and recession fears were diminishing. While the timing of rate cuts may have been overly optimistic, there was little change to this narrative in the first quarter as the resilient U.S. economy, ongoing enthusiasm around Artificial Intelligence, and broadening market participation sent global markets solidly higher, particularly in the U.S. The downside of this economic strength was that the U.S. CPI rose in both February and March, cementing concerns that the fight against inflation is far from over, delaying rate cut expectations, and putting a chill back into bond markets.

As noted above, U.S. markets posted healthy gains in the first quarter (S&P 500 Index +10.6%, Dow Jones Industrial Average +6.1%, and NASDAQ Composite Index +9.3%), supported by strong economic growth and better-than-expected corporate earnings. Energy (+13.5%) was the strongest sector, a direct result of the ongoing Middle East conflict, but broadening market participation saw 7 of the 11 sectors post returns above 8.5% for the quarter. The only sector that was negative during Q1 was Real Estate (-0.6%), which isn’t terribly surprising given its sensitivity to interest rates and the Federal Reserve’s cautious approach to rate cuts in light of recent inflation prints.

Canadian markets were also positive last quarter, with the S&P/TSX Composite Index up +6.6%, led by gains in the Energy (+13.1%) and Industrials (+11.1%) sectors. Technically, the Healthcare sector was up the most (+18.4%), but it makes up just 0.3% of the S&P/TSX Composite Index, so it contributes very little to overall performance. Despite this positive performance, lackluster growth and weakening employment trends suggest rate cuts may be nearer here than south of the border.

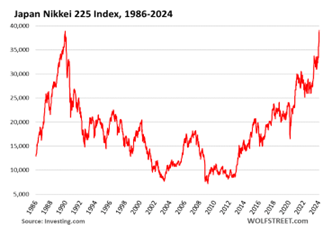

Internationally, markets were led by an exceptionally strong quarter for Japan (MSCI Japan Index +19.3%), where corporate governance reforms and a weaker yen have finally pushed the Nikkei 225 Index to its first new all-time high since 1989 (see chart to the left)! European markets (MSCI Europe ex UK Index +9.7%) were supported by improving business activity and declining inflation. Emerging market equities, however, underperformed their developed market peers (MSCI Emerging Markets Index +5.1%), as investors remained concerned about China’s growth prospects in the absence of any meaningful fiscal stimulus.

Lastly, while equity investors cheered strong economic data, fixed income investors faced a more challenging quarter as higher inflation and the strength of the U.S. economy pushed back interest rate cut expectations. This led to small Q1 declines for broad bond indices like the FTSE Canada Bond Universe (-1.2%) and the S&P U.S. Aggregate Bond Index (-0.6%).

OUTLOOK

As we progress into the second quarter of this year, we find risks relatively balanced. Broadly speaking, the economy is still in fairly good shape and corporate earnings are holding up relatively well. U.S. retail sales in March came in at double the economist expectations and U.S. manufacturing activity (ISM PMI) grew for the first time in March, after 16 straight months of contraction. However, there are some cracks beginning to show as early signs of a cooling labour market emerge (job openings are down 25% from their 2022 peak) and increased stress on younger and lower income households take hold (delinquency rates on credit cards/auto loans have risen to their highest level since before the Covid-19 pandemic). Add this to ongoing conflicts in the Middle East and Ukraine, as well as upcoming elections in the U.S., Canada, UK, and Taiwan, and there are plenty of potential catalysts to unsettle financial markets in the remaining nine months of the year. With that said, we thought we’d try to briefly answer the questions we are most often asked lately:

Aren’t We Due for a Correction?

Probably… and perhaps we’re seeing this to start April, but this shouldn’t really change our approach. Market corrections are remarkably common, in fact, there have been corrections of 10% or more in three of the last four trading years and since 1980, an average of one every 1.2 years. However, the average recovery time however is a mere four months! Trying to guess the exact timing of these peaks and valleys is next to impossible, not to mention investors give up income (dividends/interest) on investments sold. In his excellent book, “The Psychology of Money”, author Morgan Housel writes that “Time is the most powerful component of wealth. Getting wealthier is not a battle of the best returns; it is a battle of staying in the game.” We couldn’t agree more… in our experience, it is better to stay invested.

Additionally, history favours continuing to be invested after a strong first quarter. In the last 40 years there have been 15 instances where the S&P 500 Index was up 5% or more in the first quarter. Only twice has it ever ended the year lower than where it ended the first quarter, and on average it gained another 10.9% by year end. Will history repeat itself? Not necessarily, but ignoring this data seems unwise.

What About the U.S. Election?

Politics is inevitably going to be top of mind in 2024, especially with today’s intense political polarization. The U.S. election draws the most attention, but does it materially impact financial markets and economic stability?

According to analysis done by T. Rowe Price, market volatility usually starts to climb about six months before the election and peaks about one month after it. Contrary to conventional wisdom, however, they found that “the volatility around election years remained lower than in other years.” While somewhat surprising, this is reinforced by looking at the average intra-year decline during election years (-13.2%), which is slightly lower than the all-year average of -14%.

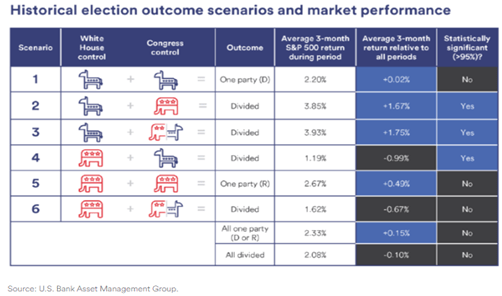

Further to this, analysis done by U.S. Bank’s strategy team (see chart on the next page) found that, regardless of the outcome, the average return for the S&P 500 Index in the three months after a U.S. election was positive, and generally the average return in these three-month periods were not statistically different than any other three-month period.

This is not to say elections have zero impact on markets. The results of the election will ultimately impact government policy, laws, and foreign relations. However, this tends to trickle down more to specific sectors rather than broad overall markets. In the mid- and longer-term, other factors have a much greater impact on markets and investment portfolios. The aforementioned study from U.S. Bank found that rising economic growth and falling inflation have been associated with returns above long-term averages, while falling growth and rising inflation have corresponded to positive but below average market returns. In short, interest rates, inflation, and economic growth all have stronger and more consistent ties with market returns and we should be focusing our attention on these items over election results.

When Will Rates Be Cut?

Probably in the second half of 2024, but it depends where you’re asking about. Canada is likely to start cutting rates before the U.S., possibly as early as June. Despite some better-than-expected results in the early part of 2024 (likely buoyed by higher oil/commodity prices), the Canadian economy seems to be weakening at a quicker pace than in the U.S. Canadian consumer spending has declined significantly and is below its long-term average contribution to GDP. The main culprit of this is higher mortgage rates, which leads to less disposable income for consumers. This may yet prove to be even more of a headwind, as recent regulatory filings from the Canadian banks and Bank of Canada show that only about 50% of total mortgages have renewed at higher rates to date (as shown in the chart on the left). This economic weaking, combined with a continued trend downward in inflation, sets the stage for the Bank of Canada to begin a rate cutting cycle relatively soon.

The U.S. economy, on the other hand, appears to be the strongest among developed markets. Given differences in our mortgage markets (a 30-year fixed rate mortgage is the predominant mortgage product there), the U.S. consumer has been much less affected by higher interest rates and continues to spend at a greater rate. As mentioned earlier, this has actually led to a slight inflation uptick in the early part of 2024. Until inflation begins to again trend downward and/or the economy weakens materially, we expect the Federal Reserve to stay on the sidelines, and we would not be surprised to see them hold off on any rate cuts until late in the year or possibly even early 2025.

Investment Ideas Update

Lastly, as we reviewed our views/outlook from our 2023 year-end commentary, it strikes us that our views have not really changed – so instead of listing these once again, we thought we’d give a quick update:

- Fixed income looks to have re-established its negative correlation/portfolio diversifier role with equities, and despite an unremarkable first quarter, our fixed income holdings performed better than the broad indices and provide good yields.

- Market participation broadened in the first quarter, with more sectors participating in the rally (as mentioned earlier).

- Value slightly outperformed growth, with the Morningstar U.S. Value Index returning +8.4%, versus the Morningstar US Growth Index at +8.3%.

- The small cap Russell 2000 Index, despite underperforming the large cap S&P 500 Index, broke out above its 20-month trading range.

Rarely should investment strategy change over a short period of time. Market cycles normally play out over years, not months, which is why we believe that success in investing requires staying invested in the right assets for your long-term objectives. As always, if you would like us to review your portfolio strategy or have any other questions or concerns, please do not hesitate to touch base.

Sincerely,

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.