Q4 2023 Market Recap

Entering the fourth quarter, investors were somewhat downtrodden as the late summer market declines had wiped out the majority of 2023’s early gains. While October offered no respite from the declines, markets roared back to life in November and December, as investors became increasingly confident that central banks were finally finished with this rate rising cycle, and that rate cuts may not be far behind. While nearly all markets rallied, it was the U.S. that proved particularly strong, thanks to a more resilient than expected economy, led by a strong labour market and surprisingly still healthy consumer spending.

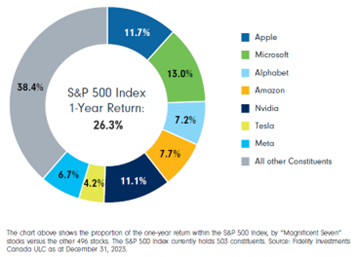

In the U.S., the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite indices all rallied more than 11% last quarter, led by the Real Estate (+17.7%) and Information Technology (+16.9%) sectors. Energy (-7.8%) was the only one of the eleven sectors that was down for the quarter. These indices’ full year returns were equally impressive, with the S&P 500 up +26.3%, the DJIA up +13.7%, and the NASDAQ Composite up a staggering +43.4%. However, the headline returns can be somewhat misleading as the breadth of market gains was very narrow in 2023. As you can see in the chart to the left, the “Magnificent Seven” stocks accounted for more than 60% of the S&P 500’s gain for the year. Without these seven stocks, the remaining 496 stocks (the S&P500 contains 503 stocks) in the index would have had an average return of 10.1% ... good, but not nearly as eye-popping.

The Bank of Canada’s restrictive policies seemed to trickle through the Canadian economy a little more noticeably than in the U.S., but despite this, Canada’s benchmark S&P/TSX Composite Index was up +8.1% last quarter, finishing the year up +11.8%. Like the U.S., Information Technology was the darling sector for the fourth quarter (+14.6%) and the year (+68.8%). Energy was the only sector to fall (-2.6%) last quarter, though it did manage to eek out a slightly positive (+1.0%) return for 2023.

Much like the Canadian economy, European economies seem to have experienced more of a slowdown in response to higher interest rates, yet they also managed to post strong returns in the fourth quarter (+10.7%) and for the year (+16.7%). China (-11.4%) and Hong Kong (-13.8%) were the only non-participants in 2023’s global rally, as China has struggled to reignite economic growth after abandoning its strict COVID lock down policies and continues to face other issues including weak consumer spending, a real estate meltdown, and record high youth unemployment.

Fixed income markets finally received a boost last quarter, as the “higher for longer” narrative was replaced by “lower and sooner” optimism. As investors began to anticipate a pivot in central bank policy towards lower rates, yields fell and bond prices rallied. Every fixed income index we follow was positive in the quarter, pushing many that were previously down for the year into positive territory.

In the end, 2023 really turned out to be a tug of war between contrasting developments in markets. On one hand, inflation remained well above historical averages and the higher cost of borrowing was a headwind to economic growth – in short, consumers had less money to spend, and that money didn’t go as far. And on the other hand, optimism and risk appetite rose (particularly in the fourth quarter), as signs pointed to interest rates peaking, inflation stabilizing, and better than expected corporate earnings.

As we enter a new year, markets seem to be increasingly confident of an economic soft landing. While we believe the odds of that has increased substantially, the market still faces challenges. Despite steadily trending lower during most of the year, core inflation (ex-food & energy) remains high and rose in December, which may force central bankers to postpone interest rate cuts. Elevated debt levels (especially in Canada) are pressuring household finances, leaving consumer spending, and thus economic growth, vulnerable. Finally, increased geopolitical risk from expanding conflict in the Middle East, the ongoing war in Ukraine, and the upcoming U.S. election all pose volatility risk to markets. At the risk of sounding repetitive, staying diversified and owning quality investments will likely be keys to success in 2024, as they often are.

OUTLOOK – Rate Debate

There are many things with the potential to roil markets in 2024, including a contentious U.S. election, expanded conflict in the Middle East, elevated recession risks (especially in Canada and the Eurozone), and over-optimism about an economic soft landing. As always though, there are reasons to be positive, such as a resilient U.S. economy, potentially more accommodative monetary policy, robust earnings growth, and attractive valuations in certain parts of the market.

Yet as we weigh these things it seems that all may pale in comparison to the “real” question of when and why do central banks start cutting interest rates? Investors (and home buyers) are clearly antsy for central banks to begin cutting rates, with markets pricing in around five cuts this year, possibly starting as early as March. Central banks, on the other hand, are only projecting three cuts as they fret over whether inflation will continue to drift toward their 2% target or reignite at first cut. The more pertinent question investors may want to ask themselves though is why are rates coming down? If rates are brought down in tandem with slowing inflation, that’s positive for the economy, and for investors as it means an economic soft landing is increasingly likely. However, if central banks need to ease policy and cut rates swiftly because the economy is deteriorating rapidly, then markets are bound to react poorly.

Our base case lies somewhere in between these two outcomes. We anticipate a mild recession in both Canada and the U.S. during 2024, with Canada likely entering and exiting recession first. As our Raymond James Investment Strategy Team has written, “If the economies slip into recession, we expect that would mean that unemployment ticks up and consumer spending declines, taking down inflation, and enticing central bankers to slowly reduce rates to limit job losses and ensure a mild and short-lived recession, but having still achieved the ultimate goal of bringing down inflation.” The key word here to us is slowly. While central bank policymakers have acknowledged that rates have probably peaked, Bank of Canada Governor Tiff Macklem commented that “it’s still too early to consider cutting our policy rate” and notes from the Federal Reserve’s December policy meeting suggested rates could remain at restrictive levels “for some time”. As such, we’ll likely see a measured approach to any cuts and expect rates to remain elevated for much of this year with any cuts more likely to occur in the latter half of the year.

Those tempering statements haven’t seemed to dissuade investors, as a recent survey by Bank of America found that 74% of fund managers expect a no-recession “soft landing” for the U.S. economy in 2024, so it appears that our view is in the minority. That said, forecasting is notoriously difficult (just last January, Bloomberg Economics’ model showed a 100% chance of recession given the magnitude of interest rate increases), so we try not to put too much emphasis on these forecasts. Instead, we try to look for opportunities that give us the best chance of success over the next 3-5 years regardless of what the next 12 months hold. While this is not an extensive list, below are a few of those ideas:

1. Fixed Income

Over the last few years, stock and bond returns have been positively correlated, meaning declines in equities have not been offset by gains in bonds as one normally expects during volatile periods. This was largely due to the rise in interest rates, as bond prices are inversely related to interest rates (bond prices fall when interest rates rise). With the rate raising cycle largely behind us and the next move in rates likely to be down, bonds are more likely to re-establish their role as a portfolio diversifier and even offer potential for capital gains.

Additionally, with current yields to maturity at a much higher level than anytime in the last decade, and those yields historically having a 94% correlation with future returns, patient investors are likely to be rewarded – especially in comparison to cash-type investments such as high interest savings funds, where interest rate cuts will be felt immediately in terms of lower rates. Accordingly, higher quality, diversified fixed income funds & ETFs look reasonably attractive. This thinking could also apply to higher quality perpetual preferred shares trading at a discount to their par value. These look particularly attractive in taxable accounts, given their higher after-tax income when compared to interest bearing investments.

2. Small/Mid Cap Stocks

While perhaps a bit of a contrarian view, small and mid cap stocks may offer investors an outsized opportunity over the coming years. Since its inception in 1979, the Russell 2000 (a small cap index) has averaged an annual return of 9.0%, while the large cap S&P 500 Index has averaged 9.1% annually over the same period. At present however, the S&P 500 is making new all-time highs, while the Russell 2000 remains more than 20% below its all-time high. Some reversion to the mean seems likely, as it is somewhat rare to see this much divergence.

As shown on the left, today’s Russell 2000 vs. S&P 500 valuations are near their lowest level since the 1999-2003 era. At that time, small caps outperformed their larger cap counterparts for more than a decade following the lows. There is no guarantee that history repeats itself, but for investors willing to accept some volatility, these currently “unloved” stocks look intriguing.

3. Dividend Payers/Value Focus

The environment for more value-focused, dividend-paying stocks may be more attractive moving forward, especially if interest rates begin to fall. While competing income classes like cash and bonds are currently offering comparable yields and lower perceived risk, they don’t offer the income/dividend growth potential that many of these quality companies provide. With the headwind of rising interest rates out of the way and many of these companies trading at compelling valuations, there appears an opportunity to lock in strong and growing income potential. Additionally, as this quality focus tends to emphasize profitable companies with strong balance sheets, it provides some defense if the economy slows and interest rates decline. A similar argument can be made for more interest rate sensitive sectors like utilities, communication services, real estate, and global infrastructure, where the rise in rates has limited share price appreciation, but the income and earnings growth potential remain.

As mentioned above, we believe markets in 2024 will be hyper focused on interest rates and when they are cut. As always, the timing of these events are unpredictable as markets can react quickly at, or even ahead of, the first signs of an improving economy or a cut in rates. Successful investing requires staying invested within your risk tolerance and in the right assets for your long-term objectives. If you would like a review of your portfolio strategy or have any other questions or concerns, please don’t hesitate to touch base. We are here to help!

Sincerely,

This Quarterly Market Commentary has been prepared by Ryan Cramp and Michael Higgins and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. The client account performance may vary from the model portfolio due to several factors, including the timing of contributions and dates invested in the model. The performance reported is that of the account that represents the model, not a composite. Performance calculation for the models may be different than the index used as a reference point. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This Quarterly Market Commentary is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund.